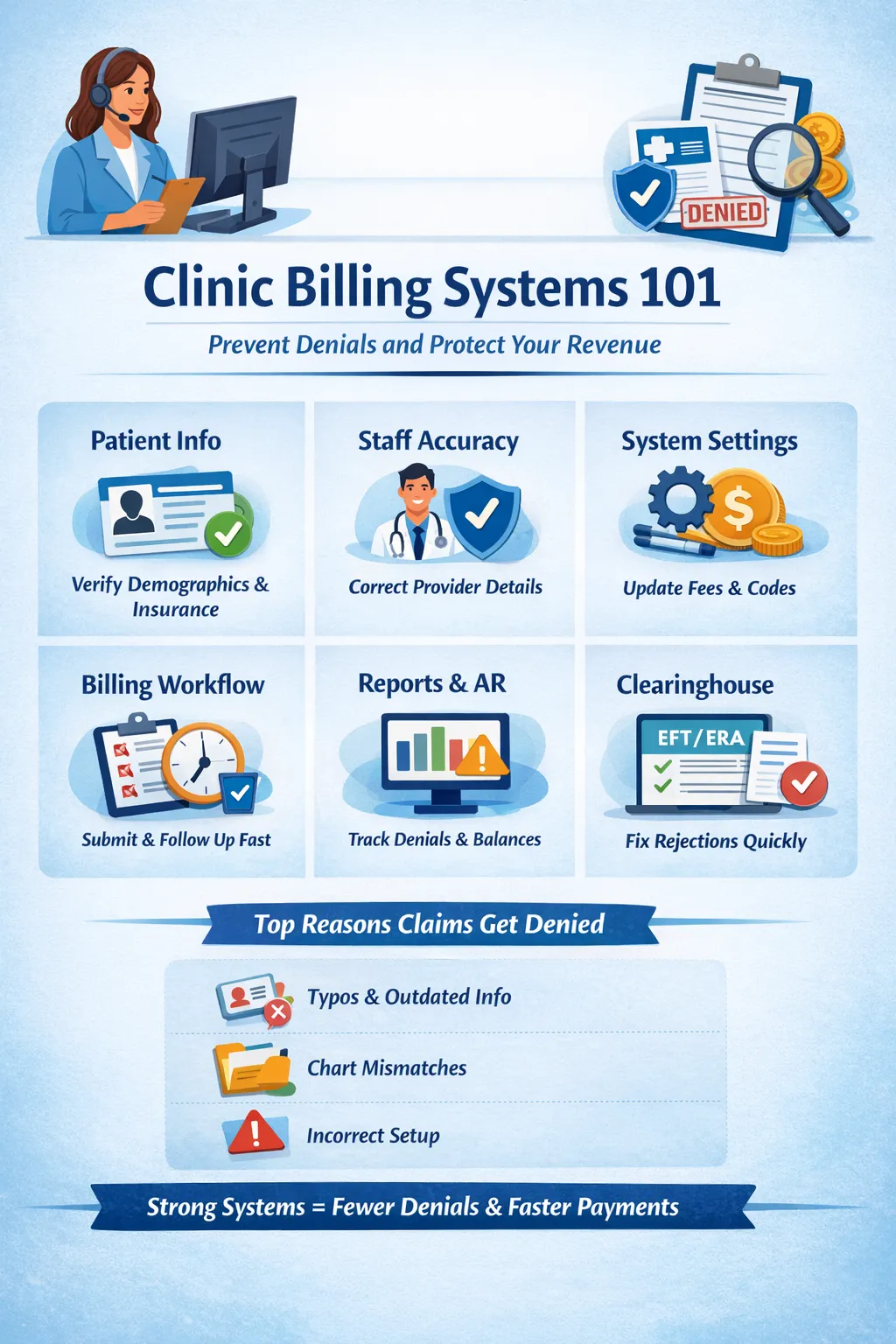

Clinic Billing Systems 101: How Strong Processes Prevent Denials and Protect Revenue

Billing problems are rarely about “bad insurance.”

More often, they come down to systems or the lack of them.

When clinics struggle with unpaid claims, patient frustration, or growing A/R, the root cause is usually small operational gaps that compound over time. The good news? Most billing issues are completely preventable with the right structure in place

Below is a practical breakdown of the core areas every clinic should routinely review to keep billing clean, compliant, and predictable.

1. Patient-Level Checks: Where Billing Really Begins

Strong billing starts before a claim is ever submitted.

Every patient account should be reviewed to ensure:

Demographics and insurance details are complete and current

Insurance cards are on file and legible

Balances (both patient and insurance) are accurate and up to date

Credits, write-offs, or unapplied payments are clearly explained in notes

Missing or mismatched information at intake is one of the most common causes of downstream denials and one of the easiest to fix with consistent front-desk workflows

2. Staff Accuracy: Small Errors, Big Consequences

Even experienced teams can unintentionally trigger denials when details are overlooked.

Key staff-related checks include:

Claims billed under the correct rendering provider

Accurate clinic details (address, NPI, tax ID) on all claims

Up-to-date provider credentialing to avoid denials or audit risk

When provider data is incorrect, payers don’t “fix it for you” they simply deny the claim.

3. System Settings: The Silent Revenue Killer

Billing software settings often get configured once… and never revisited.

Clinics should routinely verify:

Fee schedules and allowed amounts by payer

Correct co-pay and deductible fields for point-of-service collections

Proper CPT and modifier setup (no duplicates or mismatched pricing)

Incorrect settings don’t just cause denials they also lead to under-collection, which quietly erodes revenue over time

4. Billing Workflow: Claims Should Never Sit Idle

Time kills claims.

Best practice standards include:

No claims sitting unsubmitted for more than one week

Clear follow-up notes on unpaid or rejected claims

Accurate and timely posting of ERAs/EOBs

Consolidated duplicate payers to reduce confusion

A claim without follow-up is essentially money left on the table.

5. Reporting: What You Don’t Track Will Cost You

Reports aren’t just for accountants they’re early warning systems.

Every clinic should monitor:

Insurance A/R for unresolved denials or aging balances

Credit balances that may require refunds

Monthly patient A/R trends to ensure balances are stable or declining

These reports highlight issues before they turn into cash flow problems

6. Clearinghouse Review: Your First Line of Defense

Clearinghouse rejections are often ignored and that’s a mistake.

Clinics should:

Set aside weekly time to review and resolve rejections

Confirm EFT and ERA enrollment to avoid paper delays

Clearinghouse errors are usually fast fixes but only if someone is looking.

Why Most Insurance Claims Get Denied

Contrary to popular belief, most denials aren’t complex.

They’re usually caused by:

Typos in insurance numbers

Outdated patient or clinic information

Mismatches between charts and payer records

When these mistakes happen repeatedly, they signal a system problem, not a staff problem — such as incorrect payer IDs, misaligned intake forms, or fields that should be required but aren’t

The Front Desk Makes or Breaks Billing

If your front desk understands just five insurance terms, verification accuracy jumps dramatically:

Deductible

Co-pay

Co-insurance

Out-of-pocket maximum

Maximum visits

When these are verified correctly, clinics get insurance verification right roughly 95% of the time, preventing denials before they happen

Billing success isn’t about working harder it’s about building repeatable systems that catch errors early, support staff, and protect revenue.

If your clinic is seeing frequent denials, delayed payments, or patient confusion around balances, it’s usually time to audit the system, not blame the payer.

Strong billing systems don’t just improve cash flow.

They reduce staff burnout, improve patient trust, and keep care moving forward.